Non-Citizen Bank account An entire Book

Content

I have made so it set of the most expat-friendly financial institutions, where you will have an educated risk of achievements in the beginning their the fresh account. You have got certain rights and you will requirements for individuals who’lso are a tenant inside personally hired assets. Depending on the Internal revenue service, ITIN applications are generally done inside seven days (or eleven months during the top tax day). An excellent Canadian broker is a good Canadian member from a non-resident taxpayer.

Simple tips to Unlock a bank account in the us because the a good Non-Citizen

The good news is you could nevertheless discover a lender account vogueplay.com Discover More Here without one. You can also phone call otherwise visit the site of the financial or borrowing from the bank partnership before you could go to. This can allow you to understand what you’ll must provide to discover your bank account. You’ll have to do a bit of research before you could discover a bank membership in america.

- Banking institutions and therefore facilitate international profile can also be likely to allow it to be non-residents to open a great United states savings account.

- With this suggestions, you’ll have the ability to use the first step toward performing a good good economic base in the usa.

- These transfers can either end up being lead, from one lender to some other, or they can include several contacts across multiple financial institutions.

- The new FDIC makes sure a deceased person’s profile since if the individual remained live to possess six months following loss of the fresh membership proprietor.

- High, mainstream financial institutions including Bank from The usa and Chase usually demand around a few bits of data files and proof a valid U.S. home address.

- We compensated those people profile you to definitely provided a lot of available ATMs and you may twigs, to be able to effortlessly availableness bucks otherwise discover advice about form of banking items.

Paycheck Account

The united states family savings starting techniques vary based on the usa residency status you may have. Since you start your financial excursion from the U.S., just remember that , PNC Financial will be here to assist you. When you’re ready to start a good U.S. bank account, get in touch with our customer service team for additional guidance otherwise assistance. Understanding the standards to start a free account and utilizing an entire set of monetary services offered by your financial will help you to effortlessly take control of your funds. When you yourself have any queries concerning your bank account or find any items, contact your lender’s customer service personnel.

Just what are particular trick what you should bear in mind to own date-to-date banking while the a foreign federal regarding the Us?

There are not any a lot more charges or attention for the basic defense deposit choice. The newest Put Waiver solution requires fee out of a low-refundable monthly costs. The brand new FDIC makes sure a deceased person’s account as if the individual were still real time to own half dozen months following loss of the new account holder. In this elegance period, the insurance coverage of one’s holder’s membership cannot change unless the brand new accounts is actually restructured by the those individuals registered to do this.

Get rid of defense risks

No credit check, just your own foreign regulators ID, and you’re good to go. Within a couple of moments, you could start making use of your the newest membership on line otherwise any kind of time of our 90,000+ metropolitan areas over the All of us. People can also be sign in the new cellular application when and make repeating otherwise you to-day money through mastercard, electronic look at, or which have cash at over 35,100 MoneyGram urban centers. They are able to as well as today utilize its digital bag which have Fruit Pay otherwise Spend-By-Text to make costs on the move. You’ll gain access to mobile deposit, Zelle and other digital characteristics, and possess a good contactless debit cards.

If you are plans such as Flatfair aren’t insurance, he could be supported by insurance coverage, thus landlords is also be assured knowing the property are safe. Indeed, sometimes, landlords are provided a lot more security than just they’d become as a result of the standard process. Flatfair, a no deposit system i focus on, offers landlords as much as ten months shelter, twice as much they will if not discovered. If only there are a solution to improve deposit process a great deal smoother, without having to sacrifice property manager or resident interest. Keep tenants responsible instead of burdening these with highest initial deposits. The new payment try low-refundable and does not implement to the move-out can cost you or one injury to our home beyond normal don and rip.

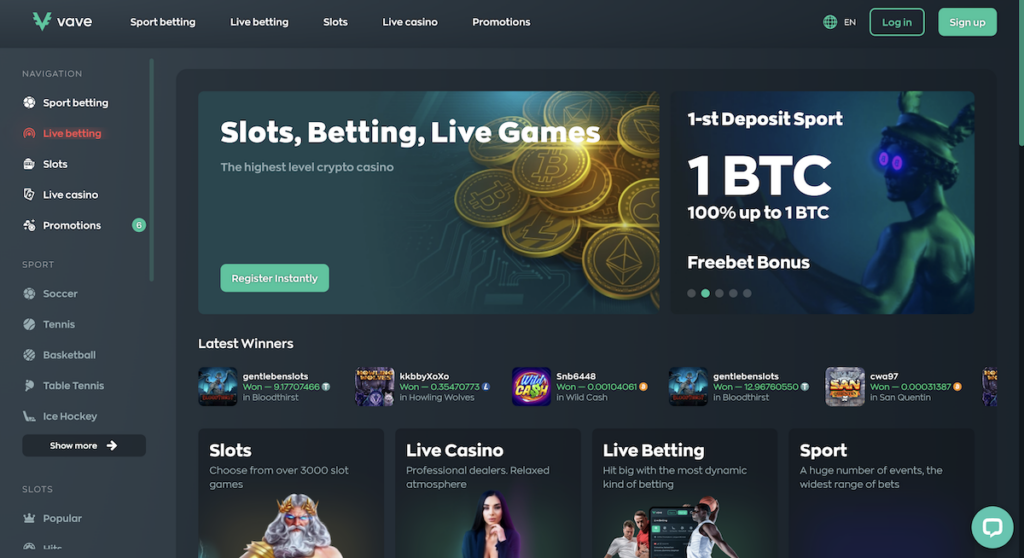

See exchanges which have a reputation safer procedures and confident representative experience. With the new no-put bonus, traders can be try trading some other crypto property that they otherwise could have been reluctant to manage. That it coverage can be expand the perspectives that assist these to come across potentially profitable options.

Generally speaking, for every owner out of a trust Account(s) is covered to $250,100000 for each and every book (different) qualified beneficiary, to a total of $1,250,one hundred thousand for five or higher beneficiaries. A rely on (either revocable otherwise irrevocable) have to satisfy the following requirements getting covered less than the newest believe accounts group. Bob Johnson provides a couple different types of later years profile one meet the requirements because the Certain Retirement Account at the same insured financial. The fresh FDIC adds along with her the fresh deposits in profile, and this equal $255,one hundred thousand.