Trendy good 100 free spins no deposit bigbot crew fresh fruit Ports

Articles

Your bet dimensions find the size and style and you will part of the brand new jackpot that you earn. The fresh position features an RTP listing of 92.97 to help you 93.97percent. The minimum matter to bet on the new position are 1, while the maximum bet try ten.

100 free spins no deposit bigbot crew | Other Video game Developed by DragonGaming

You could potentially victory as much as 4,000x the bet, that may result in substantial profits, especially in the added bonus cycles. Whether you want to is actually the new Trendy Fruits Madness demonstration or diving in the with real money, which slot delivers a nice, racy gaming experience. Funky Fruit Madness reflects Dragon Playing’s knowledge of getting amusing, mobile-amicable harbors one combine culture with reducing-boundary has. Funky Fruit Madness serves a general spectrum of participants many thanks so you can its versatile gambling possibilities. That it slot provides a vibrant good fresh fruit market to lifestyle with crazy multipliers hidden less than peels and you can Borrowing signs ready to deliver significant perks.

What is the No-deposit Extra And you will Who’ll Claim They

- Sure, the video game is available to your pc and mobile and can become played because of software otherwise browsers instead big packages.

- Check always the online game share prices regarding the T&Cs to see which game matter to your wagering standards.

- The newest gameplay is simple and you may accessible, so it is good for each other newcomers and you will seasoned slot people.

- You can find no-deposit free revolves from the BetMGM for many who come from Western Virginia.

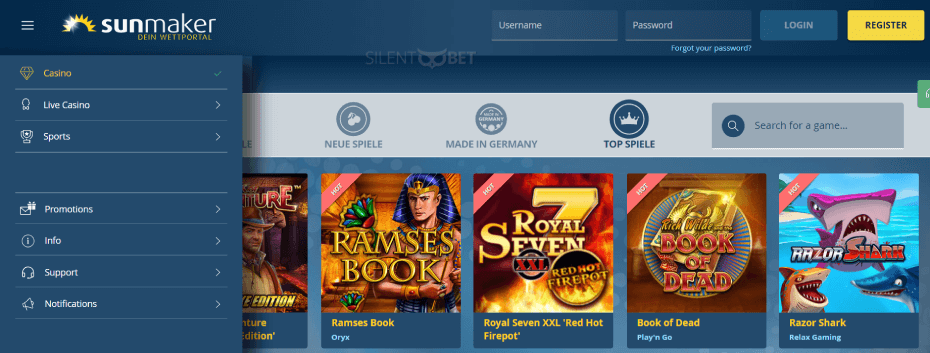

- The newest Real time Gambling establishment part can create the trick should your video game products don’t adventure you yet ,.

- Since the term explicitly says, there is no dependence on the gamer to help you put any one of their currency so you can allege the deal.

If an advantage get too much negative opinions, i twice-view they individually to the local casino.” If one thing looks suspicious, we quickly posting it to own re also-evaluation to make sure professionals do not encounter issues. Most other casinos for example Caesars simply work at objectives per week and you will racing perhaps once per month. Events calls for a leaderboard, and it’ll generally end up being something such as by far the most spins within the an amount of victories. Probably one of the most essential things to remember here is you to definitely your own pal or loved ones will have to enter no-deposit bonus rules you to definitely specifically activate the fresh suggestion extra.

I work at various kinds extra tests, however, no-deposit incentives will always be a top priority. World averages to possess bonuses or free spins cover anything from 100 free spins no deposit bigbot crew 5 so you can 20 for each activity. The biggest on the web You gambling enterprises work at that it venture to different stages. A few of the most financially rewarding form of no deposit incentives become out of customer support. But not, the best is difficult Rock which has been proven to enter into large roller professionals to your draws that can earn VIP Las vegas vacation, personal concerts, otherwise major sporting feel tickets, such as the Awesome Pan. I believe, yet not, the 2 better email address now offers come from Caesars Palace and you can Golden Nugget which do deposit suits.

The fresh objectives might be nothing tasks such wagering 50 to your slots or winning about three hand of black-jack, and you also score incentives to possess performing this. Even though exceptionally preferred in other says, no deposit 100 percent free revolves are trickier to locate from the managed online gambling enterprises in america. In my opinion, this is the greatest offer offered to You players, because it offers some what you. Even with getting below FanDuel’s 40 incentive, We still believe BetMGM is best the new put casino as the its render is actually followed by fifty 100 percent free revolves as well. The new professionals from the BetMGM is also claim a great twenty five no deposit extra as part of the invited offer having no deposit incentive requirements needed. ✅ High-really worth no-deposit fun – Every day use of a great 50 Million Gold Coin Race, where the greatest 100 professionals express the newest pond for extra enjoyable to your harbors.

FatFruit No-deposit 100 percent free Revolves

Ports game are incredibly well-known now. Cryptocurrency users are not left out both, with a different Crypto Plan offering to 2 BTC and one hundred totally free spins. Which venture is actually affirmed as the productive as of April twenty-six, 2025, which can be open to participants having fun with each other pc and you will mobile phones.

Who’ll claim and you can which are the fundamental criteria?

That it exciting offer is the citation in order to thrilling revolves and you will possible big Wins! Be sure to look at the local regulatory criteria before you choose to play any kind of time gambling establishment noted on our very own site. Very no-deposit advertisements make you gamble using your freebies immediately after, and from time to time over in the betting standards following.

Finding The new (& Updated) Roblox Codes

To conclude, Trendy Good fresh fruit Position is not difficult to experience possesses a great deal of features that make it enjoyable for an array of people. There are backlinks between your greatest you can payouts and you will one another foot game groups and you will incentive has such multipliers and progressive consequences. Yet not, specific types of one’s video game features a somewhat large difference, which means that you will find larger profits once inside an excellent when you’re and you can quicker wins shorter tend to.

This web site include playing-associated posts which can be intended for people merely. Fool around with our wagering calculator and you may review the fresh Local casino Academy to own obvious grounds from incentive terminology. Never choice more you can afford to reduce, and get away from dealing with gaming as the a way to obtain income. Now you try affirmed, get on your brand-new gambling enterprise account and availableness the new “My personal Membership” point. Looking to log in to your bank account ahead of confirming it does perhaps not produce the need effect.As soon as your membership is actually fully verified, however, you will get entry to they and you can activate your bonus. After you’ve reach the wanted casino, it’s time and energy to establish a free account.

Attempt to winnings a slice of an entire jackpot exceeding €one million and you will get daily sale and you may commitment cashback bonuses from to 25percent. No deposit bonuses try definitely worth claiming, offered you means these with the best psychology and a definite understanding of the rules. A fundamental no deposit incentive provides you with a tiny, repaired quantity of extra dollars otherwise revolves having a longer time frame to utilize them. What’s the difference between a no-deposit incentive and totally free play? You might merely claim a particular no deposit extra after per person, for each household, per Internet protocol address at the one gambling establishment.